CASHLY

Overview

Cashly is a personal finance management application designed to provide personalized guidance tailored to each user's unique financial situation. The goal is to help build healthy budgeting habits and reduce the stress of managing short- and long-term finances.

Duration

2 months (10 / 2024 - 12 / 2024)

Cashly is a personal finance management application designed to provide personalized guidance tailored to each user's unique financial situation. The goal is to help build healthy budgeting habits and reduce the stress of managing short- and long-term finances.

Duration

2 months (10 / 2024 - 12 / 2024)

Scope

UI Frame Design | UX Research | Wireframing | Rapid Prototyping | Strategy

Tools

Figma

Figjam

Jira

UI Frame Design | UX Research | Wireframing | Rapid Prototyping | Strategy

Tools

Figma

Figjam

Jira

Role

Team Lead | UX Researcher & Designer (Team of 3)

Team Lead | UX Researcher & Designer (Team of 3)

[The Ask]

SIMPLIFYING FINANCIAL PLANNING AND INDEPENDENCE

FOR YOUNG PROFESSIONALS

When transitioning into early career stages, the workforce comes with financial responsibilities and challenges — where young professionals voiced on having difficulty managing spending, finances, and relationships with money.

Our goal was to determine the best level of tools that provide spending visibility, categorization, and payment tracking to identify savings opportunities and improve finance management.

Our goal was to determine the best level of tools that provide spending visibility, categorization, and payment tracking to identify savings opportunities and improve finance management.

[Measuring Success]

Our designs resulted in 25% reduction in financial stress levels, a 30% increase in financial decision-making awareness, and improved user sentiment.

Although user research validated our solution, here are the key long-term metrics I would track if in production:

[Problem]

Where Did My Money Go?

Where Should My Money Go?

Out of school at your first job as a young professional, you likely:

- Want to keep track of spending

- Are contributing to a company 401K

- Have some student loans and/or a car loan

- Are sitting on some cash in your savings account that you’ve dutifully squirreled away over the past few months at your salaried job.

PROBLEM STATEMENT

How might we assist individuals transitioning into the early career stage to manage personal financial independency and to optimize spending needs and habits?

[User Research]

Diving into Personal Financial Stories & Insights

My team and I conducted in-depth interviews in 7 days with 6 individuals across a variety of professional industries, from 21 yrs old(<1 year of professional experience) to 28(5+ years of professional experience). We explored with 18 open-ended questions including how they currently manage their personal finances, the challenges they face, and their preferences regarding budgeting tools.

Competitor Voice of Customer (VOC)

Reviews

Constructing Cashly’s position in the market, I ventured out and conducted analysis of current competitors in the categories of budgeting and micro-investing.

[Managing Requirements]

Marking the key design objectives, our design focused on the following:

[Finding Synthesis]

Feature Prioritization Matrix

Before diving into our design process, we practiced divergent and convergent thinking to develop feature categorization based on the 2 user groups we have, existing feature evaluations and interview findings.

Information Architecture

Based on the top product features from brainstorming, we structured the IA with the information hierarchy:

1. Prioritize user intentions: Financial Goals, Budget Adjustments, Spending Awareness.

2. Condense financial content and data, drawing attention to overview metrics and spending habit evaluations.

[Meet the Target User]

These were the two (2) advertiser personas I identified with certain spending behaviors, financial needs and desires we were targeting at. For the usability testing piece, it was crucial for me to assess whether or not the page was accessible for customers with varying degrees of financial knowledge. I also used it when re-pivoting our design decisions.

[Wireframes and Usability Testing]

Zoning in on the Foundational Cash Flow

We designed iterations of the 3 core pillars: Financial Goals, Budgeting Planning, Cash Flow and practived usability testing on 5 volunteers. The final comparison result deck can be found here

A data-driven upsell

See their money moving

From research, we knew that emotional connection and awareness to spending was crucial.

Our final iteration also adopted a dynamic "cash flow" animation to simulate users tangible feeling of spending physical money.

[Final Solution]

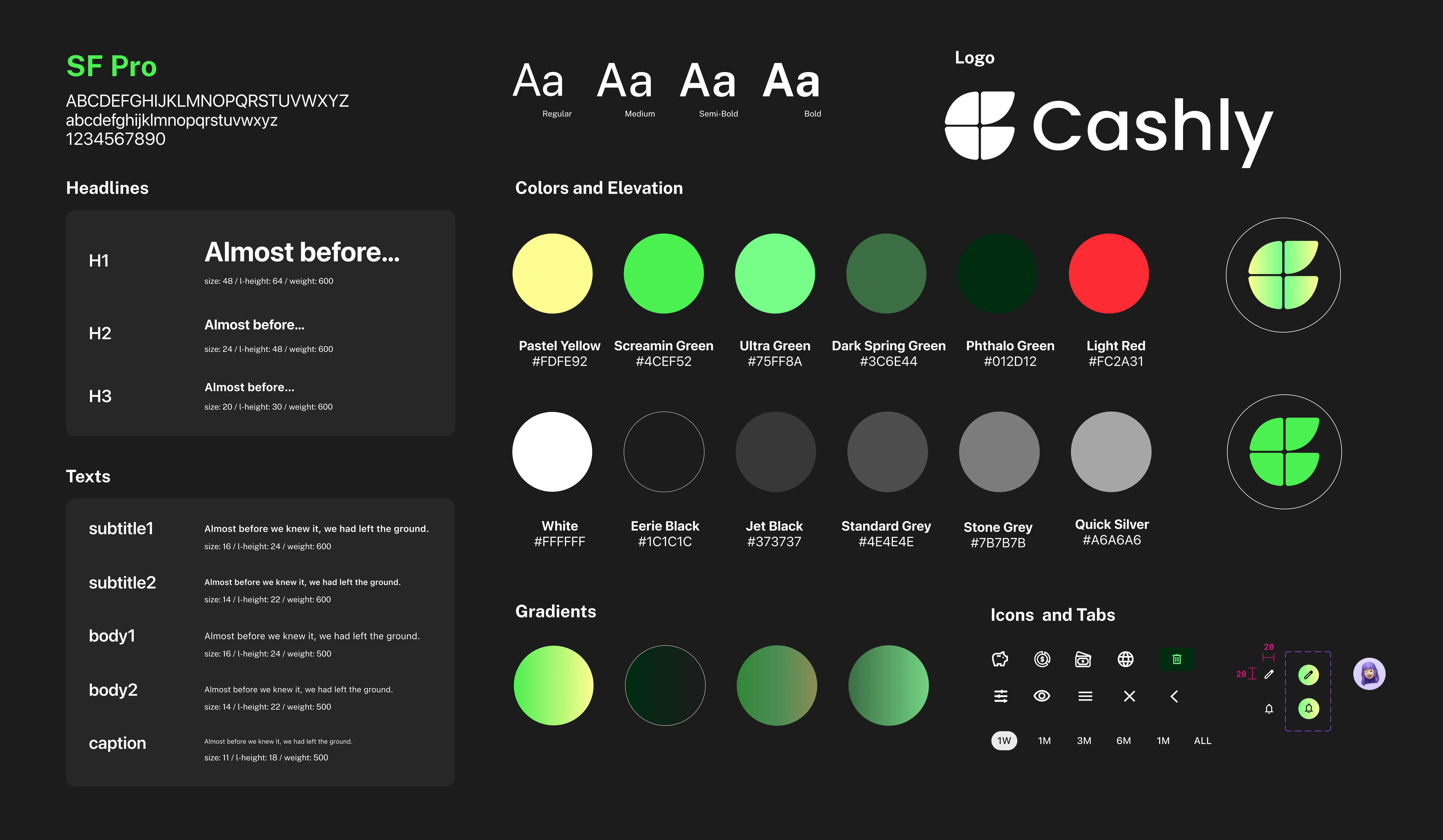

[Brand Identity]

[Reflections]

3 things I would do differently next time

1. Prioritize End-User Experience on a Strict Timeline

With stakeholder meetings taking place every week, it gave me the opportunity to make constant adjustments to real-time insights, enabling more informed design decisions.

2. Be a Proactive Team Player

I learned to do continuous learning and adapting working with developers. With the help of product managers and lead designer, I created scalable designs that resolved user paint points and edge cases.